The new Corporate Sustainability Reporting Directive (CSRD) is coming and will, directly or indirectly, affect the majority of transport and logistics companies. We have taken a closer look at what the CSRD is, which companies it concerns, what exactly needs to be reported, and how shippers, carriers and forwarders can brace for the challenges and opportunities it implies. We have also addressed the most essential CSRD-related questions and answers for the transport and logistics sector.

This article covers the following topics:

- What is the CSRD?

- Which companies need to report under CSRD requirements?

- Implementation timeline

- CSRD focus areas: What needs to be reported?

- The concept of double materiality

- Focus area climate change: A closer look

- Implications for transport and logistics suppliers

- Q&A

What is the CSRD?

The CSRD is one of the major vehicles by the European Union for delivering the European Green Deal – an ambitious effort aimed at achieving a carbon-neutral Europe by 2050. An essential part of this effort is to bring sustainability reporting to new levels and to raise awareness and significance for it among companies. The CSRD, for the first time, defines a common reporting framework for non-financial data, encompassing not just climate change but broader Environmental, Social and Governance (ESG) metrics. Through the CSRD, corporate sustainability reporting becomes an obligatory part of companies’ year management report and requires auditors’ assurance.

In summary, the CSRD has two main aims:

- Provide transparency about the social and environmental risks that companies face and how their activities impact people and the environment.

- Provide transparency for external stakeholders and investors about financial risks and opportunities arising from the impact of climate change and other sustainability issues, with the goal to redirect investments towards more sustainable businesses.

Key takeaways from the CSRD:

- The CSRD shall become an integrated part of companies’ year management reporting.

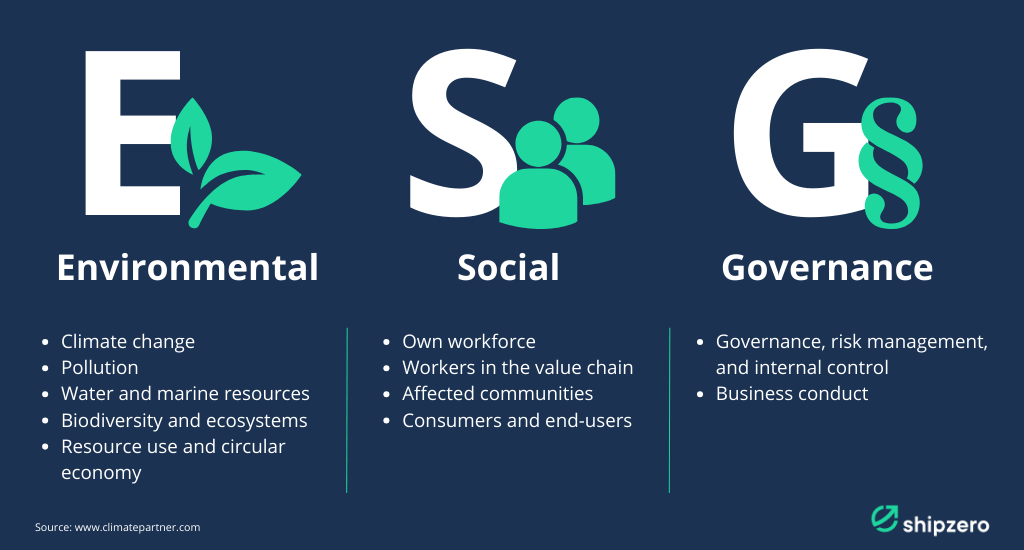

- It has to be verified by accredited or certified auditors against European sustainability reporting standards (ESRS) adopted on 31 July 2023. ESRS are data-intensive disclosures covering Environmental (ghg emissions, energy, waste, waster), Social and Governance metrics (see Figure 2).

- ESRS aim to ensure that companies across the EU report comparable and reliable sustainability information.

- For specific sectors, including transport, a dedicated set of reporting ESRS will be issued in 2024. For the transport sector a resemblance with ISO 14083 standards seems logical.

- A cornerstone of the CSRD is the concept of double materiality assessment of inward and outward impact of company operations on sustainability-related impacts. It defines the granularity of disclosure for environmental and social aspects in the report.

- Penalties for non-compliance are to be established by the EU member states. Following the Non-Financial Reporting Directive (NFRD)[1]of which the CSRD is the successor, companies may face fines of up to either €10 million, 5% of the total annual turnover or twice the total profits made/losses avoided due to the breach.

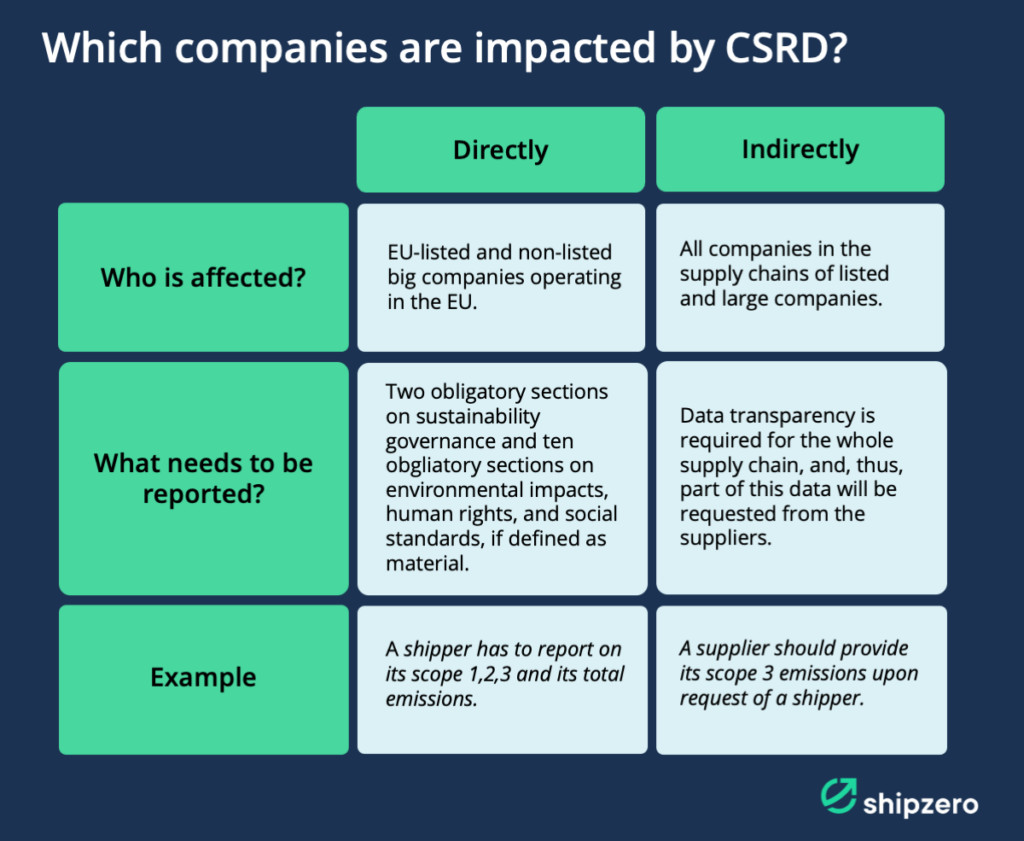

- The CSRD directly impacts listed and large-sized companies operating in the EU and indirectly impact their entire supply chain, particularly for the reporting of scope 3 emissions.

Which companies need to report under CSRD requirements?

The CSRD came into force earlier this year, requiring large[2] companies operating in the EU and EU-listed[3]companies to publish detailed sustainability reporting on a yearly basis with the information verified by certified auditors. After the full implementation, 50,000 companies are directly impacted in the EU, and 15,000 in Germany.

While the CSRD first and foremost concerns large and EU-listed companies, the entire supply chain of these companies will indirectly be impacted as well, as the following table indicates.

The reporting directive requires companies to disclose information for their entire supply chain on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.

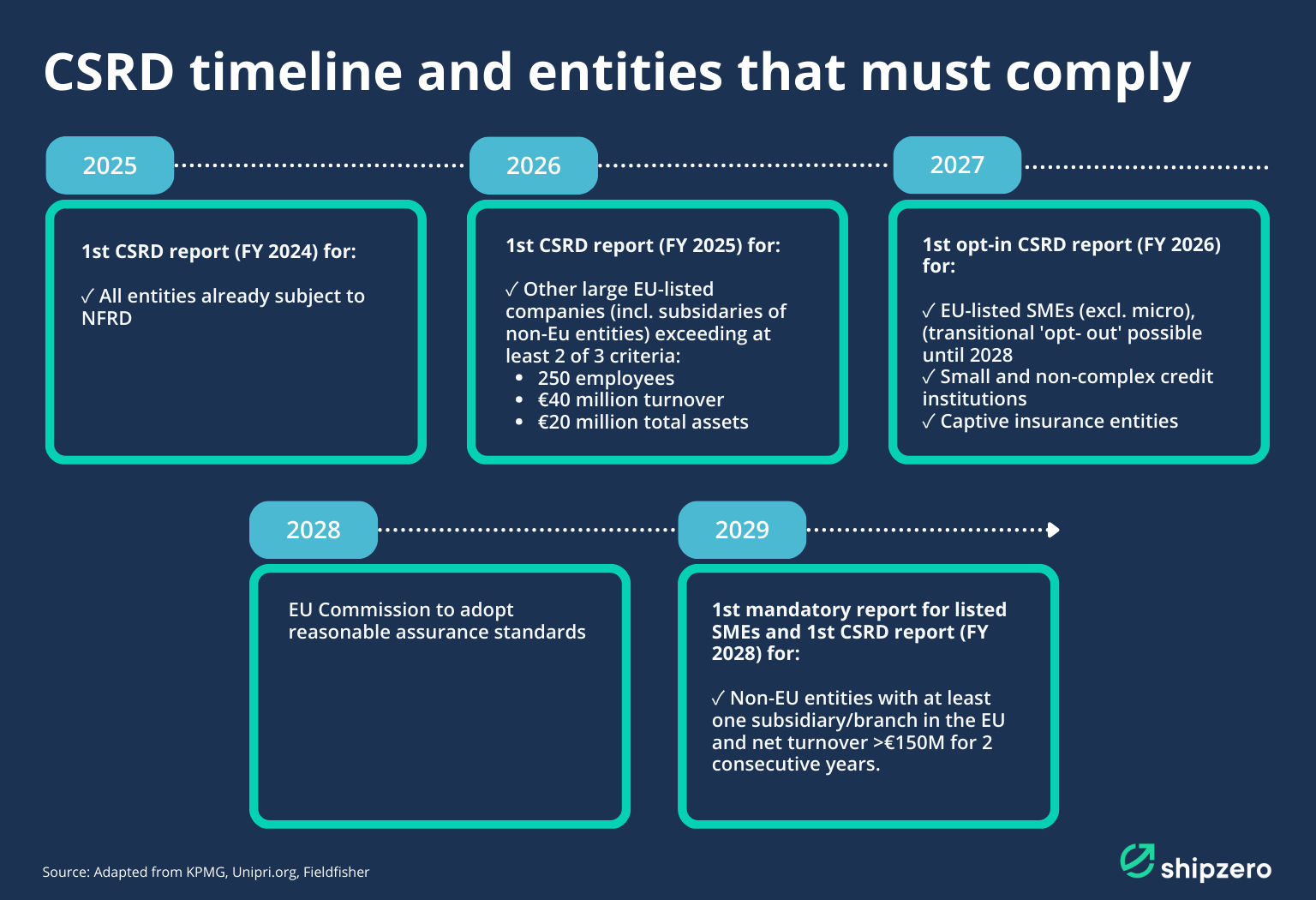

With the phased approach (see figure 1), the first phase will already start affecting companies in 2024 if they fulfill two of the three following criteria:

- € 20 million balance sheet

- € 40 million net turnover

- average number of 500+ employees

Those large and EU-listed companies have to publish their first report in 2025 for the FY 2024. The timeline below shows the CSRD implementation stages for other concerned companies.

CSRD focus areas: What needs to be reported?

Given the extensive list of reporting requirements for the three focus areas Environmental, Social, and Governance (ESG), companies need to start preparing now. The table below provides an overview of the subareas that each focus area entails.

The CSRD includes general disclosure requirements and specific ones. General disclosure requirements cover general sustainability principles, strategy, governance and materiality assessment. While the general disclosure requirements are obligatory for every CSRD-concerned company, ESG and the respective subsections are only mandatory for specific companies, if indicated as a result of the materiality assessment.

The concept of double materiality

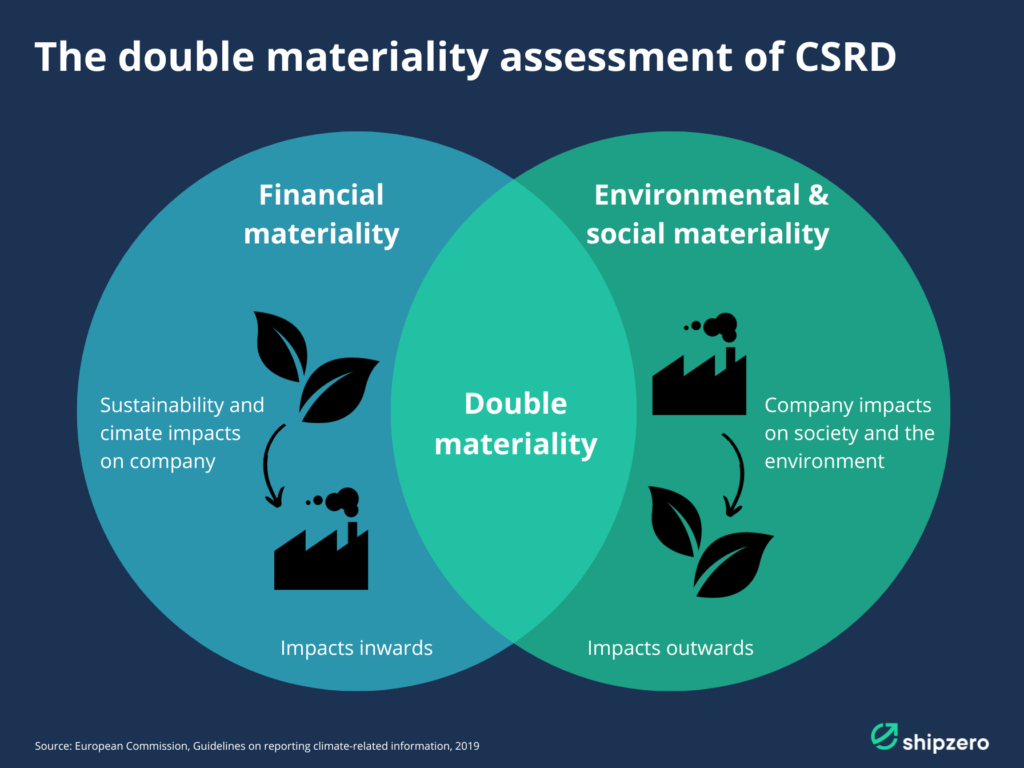

A core element of the CSRD is the so-called double materiality assessment which defines the specific sections of the reporting requirements a company needs to report on.

Materiality assessment includes topics such as inward and outward impact of company operations on sustainability-related issues. It defines the granularity of disclosure for environmental and social aspects in the report. A full list of topics to be assessed is provided in Figure 2.

Materiality means the material impact of the environment on company operations, and vice versa, the impact of company operations on people and the environment (see Figure 3). This two-side impact consideration is called the “double materiality” CSRD approach.

- The first materiality type is outside-in, financial materiality: when a sustainability risk affects a company’s financial performance, cash flow, its access to finance, or cost of capital.

Example. A company’s business model depends on a natural resource – for example, water – and it is likely to be affected by changes in the quality, availability, and pricing of that resource.

- The second materiality type is inside-out, environmental, and social materiality, how a company impacts the environment and social spheres.

Example 1. A company´s activities result in negative impacts, e.g., on local communities, and become subject to stricter government regulation (extra price, potential capital-compliant investments and/ or reputational costs).

Example 2. A company contributes to air and water pollution or greenhouse gas emissions.

The final example illustrates that the climate change section of the CSRD concerns the majority of companies, since pretty much any company that is operating assets is generating GHG emissions (either directly or indirectly through its supply chain).

Focus area climate change: A closer look

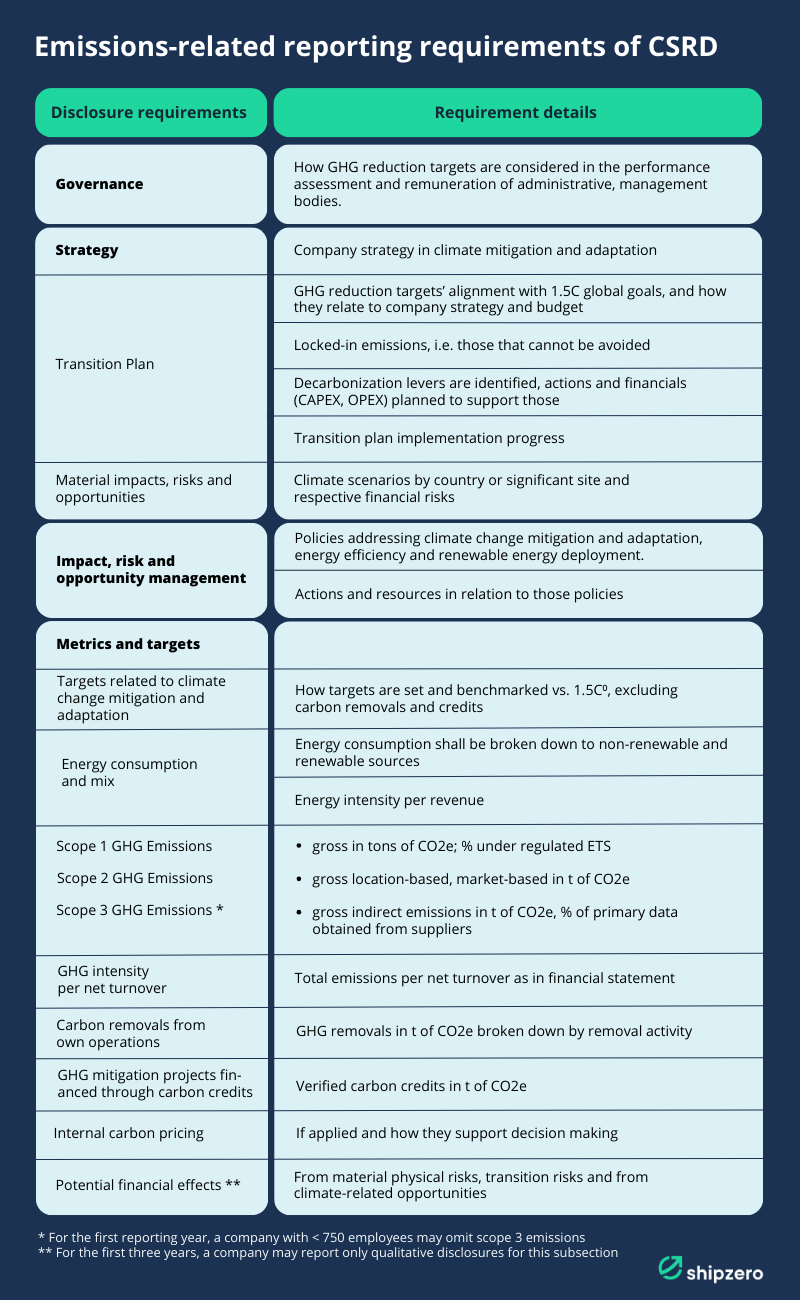

The CSRD reporting standards annex contains detailed information on reporting requirements for each topical section. Since the climate change section concerns the majority of companies and relates to our expertise the most, this is the section we focus on in this article.

The principal goal of the climate change section is to disclose:

- How does the reporting company affect climate change, its material positive, negative and potential impacts, what are its mitigation plans and capacity, and how is the strategy and business model adapted to those plans to limit global warming to 1.5°C?

- What are the financial effects (short to long-term) of climate risks and opportunities for the company?

The climate change section of the CSRD consists of 4 subsections and 12 groups of detailed reporting requirements:

- Governance

- Strategy

- Impact, risks, and opportunity management

- Metrics and targets

The figure below describes each of these sections and respective requirements.

Implications for transport and logistics suppliers

The new CSRD requires large and EU-listed companies to disclose 1) their current GHG emissions, 2) decarbonization road towards the 1.5°C target, 3) illustrate the concrete measures, and 4) report the progress. However, especially the CSRD section on climate will also concern suppliers, since GHG emissions of the entire supply chain must be reported, including Scope 3 emissions. In a company’s total carbon footprint, Scope 3 emissions constitute the largest portion, for which suppliers are responsible. Therefore, the regulation ´indirectly´ extends its scope and concerns suppliers, such as forwarders and transport service providers, after all and thus influencing the dynamics of supplier relationships.

Examining this shift from three key perspectives—upcoming tender processes, cost efficiency, and preparedness for future regulations—we see significant implications:

- Competitive advantage. In upcoming tender processes, having transparent and reliable emissions data may become one of the key factors alongside the service price that sets suppliers apart and gives them a competitive advantage.

- Cost efficiency. With the new CO2-toll for trucks (Germany) and extension of the EU ETS in 2027, emission costs become a tangible aspect of transportation services. A CO2 emissions management system such as shipzero can provide detailed information about emissions emitted per shipment but also the entire company’s carbon footprint. This not only helps with responding to reporting requirements in an efficient way but forms the basis for an emission and thus cost-efficient fleet as well as other decarbonization measures.

- Readiness for future regulations and industry transformation. Considering the ambitious targets for 2050, CSRD prompts companies and their suppliers to not only comply with current regulations but also to proactively prepare for more stringent future regulations and data transparency. This forward-thinking approach ensures adaptability and resilience in an evolving regulatory landscape.

Q&A

Question 1. For a CSRD-concerned company, whether shipper, LSP or carrier, which ESG reporting standards are mandatory?

The scope of mandatory sustainability reporting depends on the double materiality assessment. General and disclosure requirements (p.1 and p. 35 of the annex) sections are mandatory for each company. However, the detailed Environmental, Social, and Governance requirements are mandatory if relevant sections were defined as material (i.e. significantly impacting its financial position or/and impacting the external environment and social).

If one or more environmental or social areas are considered non-material, they are skipped in reporting. An important note, if a company considers climate change as non-material, it has to provide a detailed explanation on that. This data point is subject to assurance by the verification body.

Question 2. How does the CSRD impact suppliers of big or EU-listed companies?

CSRD has an immediate indirect effect on many 1st tier suppliers of those CSRD-concerned companies since they will be asked to provide primary environmental and social data (e.g. GHG emissions and GHG reduction targets for scope 3, workforce conditions, or air and water pollution impacts). It can be assumed that purchasing policies of CSRD-concerned companies, and respective tender processes will become stricter from the perspective of this type of data-sharing requirements.

Question 3. How to prepare for the CSRD?

The complexity and variety of CSRD reporting standards mean that it will require significant resources for implementation. Here are the key steps to take to prepare:

- Stay informed about updates and developments of CSRD.

- Ensure management and key stakeholders of the company are aware of major CSRD aspects, timelines, and responsibilities.

- Effectuate double materiality assessment to understand the scope needed for reporting.

- Identify information sources for all relevant reporting sections.

- Consider using a CO2 emissions management platform such as shipzero to help you quantify and report your relevant sustainability information.

- Ensure sustainability target setting and KPIs and timely progress evaluation.

Question 4. Shall CSRD reports be verified by auditors?

The CSRD makes the auditing of sustainability reports mandatory. The CSRD report has to be verified by a qualified third-party assurance provider against:

- ESRS reporting requirements;

- Processes used to identify the information reported;

- Report digitization, XHTML format to feed EU base; CSRD requires all reports to be prepared in an electronic reporting format to facilitate accessibility, analysis, and comparability. This means reports need to be in XTML format and use XBRL technology, as per the European Single Electronic Format (ESEF).

- Compliance with the reporting requirements of Taxonomy Regulation.

The EU Commission will first issue limited assurance standards (i.e. basic) followed by reasonable (i.e. sophisticated) assurance standards to ensure the process adopts the relevant due diligence needed. Member States may apply national assurance standards, procedures or requirements as long as the EU Commission has not adopted an assurance standard covering the same subject matter.

Question 5. My company already prepares sustainability report under other reporting standards (e.g. GRI, CDP). Can I use these reports to comply with the ESRS reporting standards of CSRD?

Currently, ESRS has reached a high level of alignment with the standards of the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI). GRI has confirmed that existing GRI reporters will be well-prepared to report under the ESRS.

CDP: no mutual alignment statements made yet but CDP sees their followers as ‘well-prepared’ for CSRD reporting.

Question 6. Are there industry specific CSRD reporting standards for transport companies?

The European sustainability reporting standards (ESRS), relevant for all industries, were adopted by the EU Commission on 31 July 2023. Sector-specific standards, including those for the transportation industry, are expected to be adopted by June 2024. We will keep you informed.

Question 7. What happens if my company fails to report in accordance with CSRD requirements? Are there any consequences?

The Directive provides for three levels of sanctions:

- A public statement naming the individuals responsible and the nature of the breach

- An order requiring the responsible person to cease the conduct

- Penalties for non-compliance are to be established by the EU member states. Following the Non-Financial Reporting Directive of which CSRD is the successor, companies may face fines of up to either €10 million, 5% of the total annual turnover or twice the total profits made/losses avoided due to the breach.

Question 8. How can shipzero help shippers, carriers and forwarders to report in line with CSRD requirements?

shipzero is a data platform that enables effective emissions tracking in global freight transportation. It can help organisations to:

- Gain data transparency and detailed insights into their own and suppliers scope 1,2,3 emissions.

- Establish GLEC-accredited calculations of transport and logistics emissions for carbon accounting as well as for manual ad hoc analyses or tender processes.

- Calculate on a shipment basis as well as on aggregated level for the assessment of your company carbon footprint (CCF).

- Provide comprehensive data input based on interfaces (TMS / ERP), available data from carriers (see CMA), sources (IMO number or IATA codes for exact route) or manual uploads (e.g. master data).

- Focus on purposes beyond reporting: identification of decarbonization potentials and allocation of CO2 reductions during Green Freight Services.

To learn more about CO2 emissions management and what shipzero can do for your company, get in touch with one of our industry experts.

Question 9. Are there any templates that ease the CSRD reporting process?

Yes, the European sustainability reporting standards (ESRS), alongside with the reporting standards, suggest the templates that can be used in the report. Those templates are embedded in respective sections of the ESRS.

—

Footnotes:

[1] NFRD was set in force in 2016 and requires large and EU public interest companies to publish a non-financial report on their ESG performance together with their annual management report.

[2] Large-sized undertakings falling under at least two of the three following criteria: balance sheet (€20 million), net turnover (€40 million), employees (250); for CSRD the employee criteria is changed for 500 for the 1st phase.

[3] Entity, trading transferable securities on the EU-regulated market, a credit, insurance undertaking, or other public interest entity. Excluding listed micro-enterprises: balance sheet (€350,000), net turnover (€700,000), employees (10).

Sources:

- Publication of the Corporate Sustainability Reporting Directive (CSRD) in the Official Journal https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32022L2464

- Corporate Sustainability Reporting Directive. https://www.csr-in-deutschland.de/DE/CSR-Allgemein/CSR-Politik/CSR-in-der-EU/Corporate-Sustainability-Reporting-Directive/corporate-sustainability-reporting-directive-art.html

- European sustainability reporting standards – first set

- Questions and Answers on the Adoption of European Sustainability Reporting Standards. https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043

- ESMA. Electronical reporting. https://www.esma.europa.eu/issuer-disclosure/electronic-reporting#:~:text=Reflecting%20the%20political%20agreement%20on,required%20by%20Article%208%20of

- Frequently Asked Questions About the E.U. Corporate Sustainability Reporting Directive. https://dart.deloitte.com/USDART/home/publications/deloitte/heads-up/2023/csrd-corporate-sustainability-reporting-directive-faqs

- CSRS and GRI interoperability statement. https://www.globalreporting.org/news/news-center/efrag-gri-joint-statement-of-interoperability/

- CDP and CSRS alignment. https://www.cdp.net/en/articles/companies/many-companies-are-well-prepared-for-new-european-sustainability-reporting-rules